are charitable raffle tickets tax deductible

The IRS has determined that purchasing the chance to win a prize has value that is. To claim a deduction you must have a written record of your donation.

Twenty 22 Raffle 13 Tickets American Suppressor Association

Are raffle tickets for a nonprofit tax-deductible.

. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The cost of a raffle ticket is not deductible as a charitable contribution even if the. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by.

A gala dinner costs. The irs has adopted the position that the 100 ticket. What you cant claim.

If the organization fails to. This is because the purchase of raffle. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

However the answer to why raffle tickets are not tax-deductible is quite simple. The IRS has determined that purchasing the chance to win a prize has value that is. This might sound nonsensical on the.

The IRS has determined that purchasing the chance to win a prize has value that is essentially. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over. The purchase of a raffle ticket is not considered a charitable donation.

You may be able to claim depreciation on the property you donate as part of the raffle prize. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

Withholding Tax on Raffle Prizes Regular Gambling Withholding. A raffle ticket is not deductible as a charitable contribution in the United States. You cant claim gifts or donations that provide you with a personal benefit such as.

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Although you cant take a tax deduction for purchasing a raffle ticket you could deduct the amount spent on losing tickets as long as you had at least that amount of gambling winnings. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. An organization that pays raffle prizes must withhold 25 from the winnings and report this.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Ticket Events Set Tax Deductible Amounts Givesignup Blog

Nonprofit Raffles State Of California Department Of Justice Office Of The Attorney General

How Charitable Tax Deductions Work Howstuffworks

Bike Raffle For High School Scholarships Rotary Club Of Westborough

Charitable Raffle Eagle Mount Therapeutic Recreation Great Falls Mt

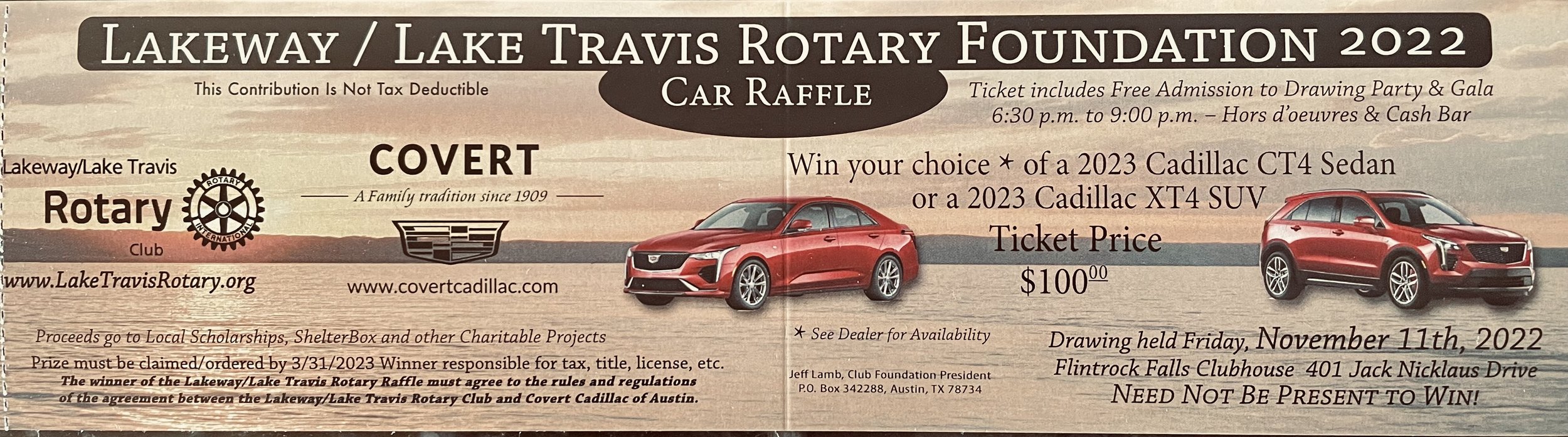

Raffle Rotary Club Of Austin Westlake

Is Your Nonprofit Ready For A Raffle Mauldin Jenkins

The Loudoun Education Foundation Golf Classic Loudoun Education Foundation

Knights Of Columbus 20 000 Raffle St Jane Frances De Chantal Roman Catholic Church

How To Sell Raffle Tickets Online The Jotform Blog

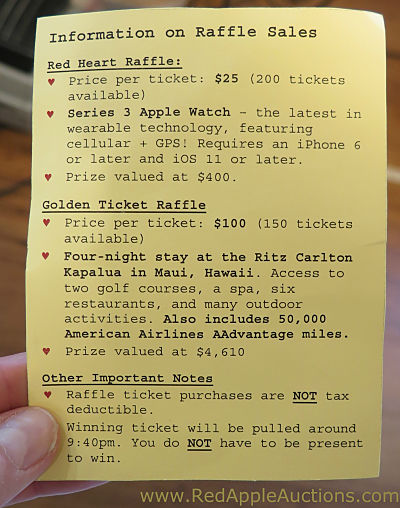

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar

Charitable Contributions You Think You Can Claim But Can T Turbotax Tax Tips Videos

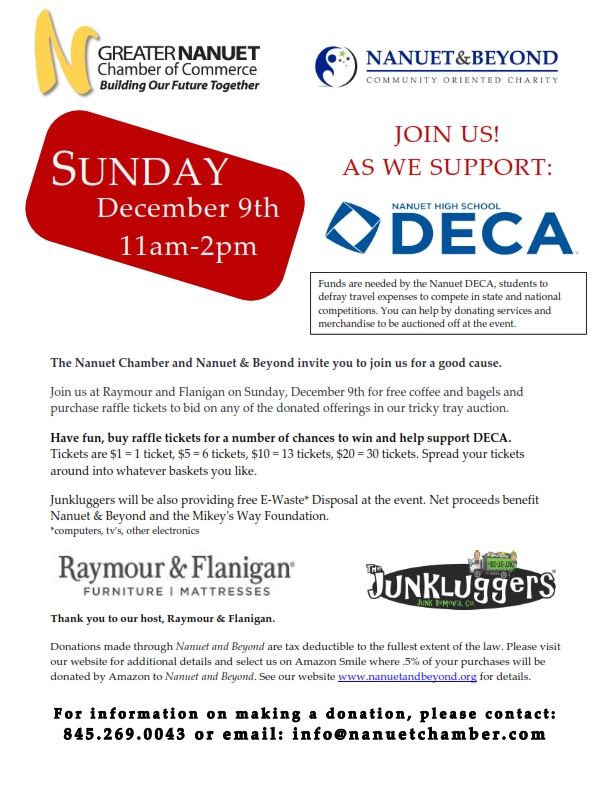

2018 Tricky Tray To Benefit Deca Nanuet Chamber Of Commerce

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic

Are Nonprofit Raffle Ticket Donations Tax Deductible

Simb Dream Raffle 100 Soroptimist International Of Manhattan Beach

Are Nonprofit Raffle Ticket Donations Tax Deductible